AARP Medicare Supplement: Understanding Your Options

As a senior citizen, it's important to have a clear understanding of your healthcare options. With the AARP Medicare Supplement, you have the opportunity to receive additional coverage to help you manage your medical expenses. In this article, we will explore the AARP Medicare Supplement, its benefits, and how it can help you better manage your healthcare costs.

What is the AARP Medicare Supplement?

The AARP Medicare Supplement is a type of insurance policy that is designed to provide additional coverage for those enrolled in Medicare. This policy is offered by United Healthcare and is available exclusively to members of the AARP. It provides a range of benefits, including coverage for deductibles, copayments, and coinsurance, as well as coverage for hospital stays, skilled nursing facilities, and home health care.

What Does the AARP Medicare Supplement Cover?

The AARP Medicare Supplement covers a wide range of medical expenses, including hospital stays, skilled nursing facilities, home health care, and more. It also provides coverage for deductibles, copayments, and coinsurance, which can help you manage your out-of-pocket costs.

How Does the AARP Medicare Supplement Work?

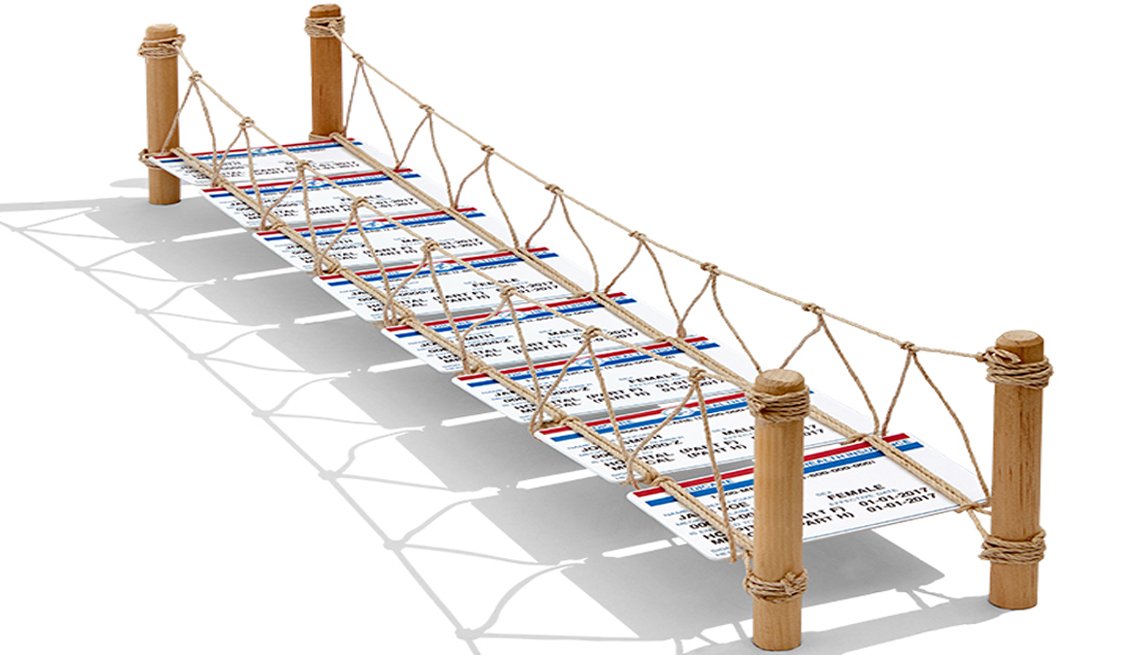

The AARP Medicare Supplement works by supplementing the coverage you already receive through Medicare. It is designed to fill the gaps in your Medicare coverage, so you are not responsible for paying the entire cost of your medical expenses. With the AARP Medicare Supplement, you can choose from a range of plan options, so you can find the coverage that is right for you.

Who is Eligible for the AARP Medicare Supplement?

To be eligible for the AARP Medicare Supplement, you must be a member of the AARP and enrolled in Medicare. You must also reside in a state where the AARP Medicare Supplement is offered. If you meet these eligibility requirements, you can enroll in the AARP Medicare Supplement and start receiving the benefits it provides.

What Are the Advantages of the AARP Medicare Supplement?

The AARP Medicare Supplement offers a range of advantages, including:

- Comprehensive coverage for a range of medical expenses

- Coverage for deductibles, copayments, and coinsurance

- A choice of plan options, so you can find the range that is right for you

- Easy enrollment process

- Affordable premiums

How to Enroll in the AARP Medicare Supplement

Enrolling in the AARP Medicare Supplement is easy and straightforward. You can enroll online or by phone, and you will need to provide some basic information about yourself and your Medicare coverage. Once you have enrolled, you can start receiving the benefits of the AARP Medicare Supplement.

What to Consider When Choosing a Plan

When choosing a plan, it's important to consider your medical needs, your budget, and your personal preferences. You should also consider the plan's coverage, premium costs, and network of healthcare providers. With the AARP Medicare Supplement, you have the option to choose from a range of plans, so you can find the coverage that is right for you.

Conclusion

In conclusion, the AARP Medicare Supplement is a valuable option for seniors who are enrolled in Medicare and looking for additional coverage. With a range of benefits, comprehensive coverage, and easy enrollment, it's a great choice for anyone looking to manage their healthcare costs. Whether you're looking to fill the gaps in your Medicare coverage or just want peace of mind, the AARP Medicare Supplement is an excellent option.

FAQsWhat is the AARP Medicare Supplement? The AARP Medicare Supplement is a type of insurance policy designed to provide additional coverage for those enrolled

Comments

Post a Comment