"Insurance Industry Trends: What's New and What's Next"

The insurance industry is ever-evolving and staying up-to-date with the latest trends can be daunting. In this blog post, we will provide an overview of the current trends in the insurance industry, including the types of insurance available, technological adoption, changing risk tolerance and regulations, and personalization and customer service trends. Get ready to dive in and explore the latest and greatest changes in the insurance industry.

Types Of Insurance-What Is Covered?

Insurance is a vital part of our lives, and it can help to protect us from a variety of risks. Whether you're worried about a natural disaster like a hurricane or you're concerned about the aftermath of a tragic event, insurance can help to protect you. In this section, we'll outline the different types of insurance and what each covers. We'll also explore the emerging trends in life and property insurance, as well as how technology is shifting the landscape of the insurance market. Finally, we'll provide tips on how insurers are adapting to changing customer needs, as well as insights into what's next for the insurance industry. So whether you're looking to buy or renew your policy, read on for all the information you need!

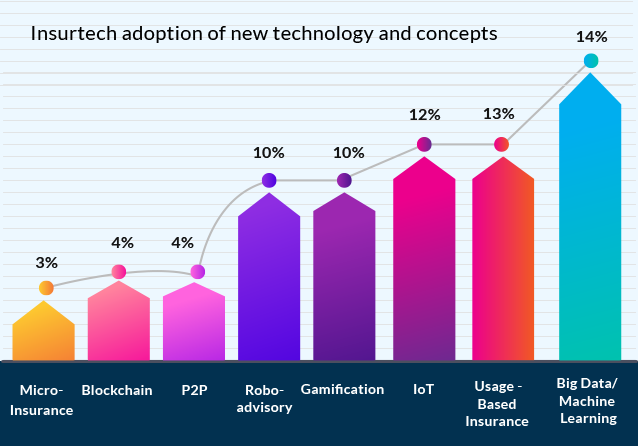

Technological Adoption In The Insurance Industry

In today's world, technology adoption is driving customer experience and industry growth. Insurance companies are recognizing the importance of digital channels and are quickly adopting the latest technologies to better serve their customers. Cloud computing, big data, automation, and telematics are all playing a role in this rapid adoption, helping insurers improve operational efficiency and reduce costs.

Digital channels are redefining insurance sales & distribution. Insurers now have more options for selling their products than ever before. They can use digital channels to reach potential customers directly, or they can partner with online insurers to provide a comprehensive product offering. By using digital channels, insurance companies can drive better customer experience by providing a simplified shopping experience and faster turn-around times for claims processing.

Cloud computing is also playing an important role in driving industry growth. By storing data on the cloud, insurers can access it from anywhere in the world at any time. This makes it easier for them to update their websites and product offerings as new information comes available (no need to rebuild entire websites!). In addition, cloud-based applications allow insurers to automate processes so that they're able to save time and money on administrative tasks.

Telematics is another key technology that's helping to drive industry growth. With telematics technology, insurers can track the movements of drivers (and other vehicles) throughout the country in real-time for risk assessment purposes. This helps them identify risky drivers early on and take appropriate action before accidents happen! Additionally, telematics devices can be used to monitor customer assets (such as cars or homes) so that risks associated with those assets can be identified early on too!

IoT devices are playing an important role in accelerating industry growth by helping insurers detect risks earlier than ever before. For example, IoT devices help insurers monitor claims history in order to identify patterns that may indicate fraudulent behavior, something that would otherwise be difficult or impossible to do manually. By taking advantage of these technologies together – digital channels, cloud computing, telematics, and IoT – insurers are able to reduce costs while improving customer experience.

Benefits Of Digital Adoption For Insurance Companies

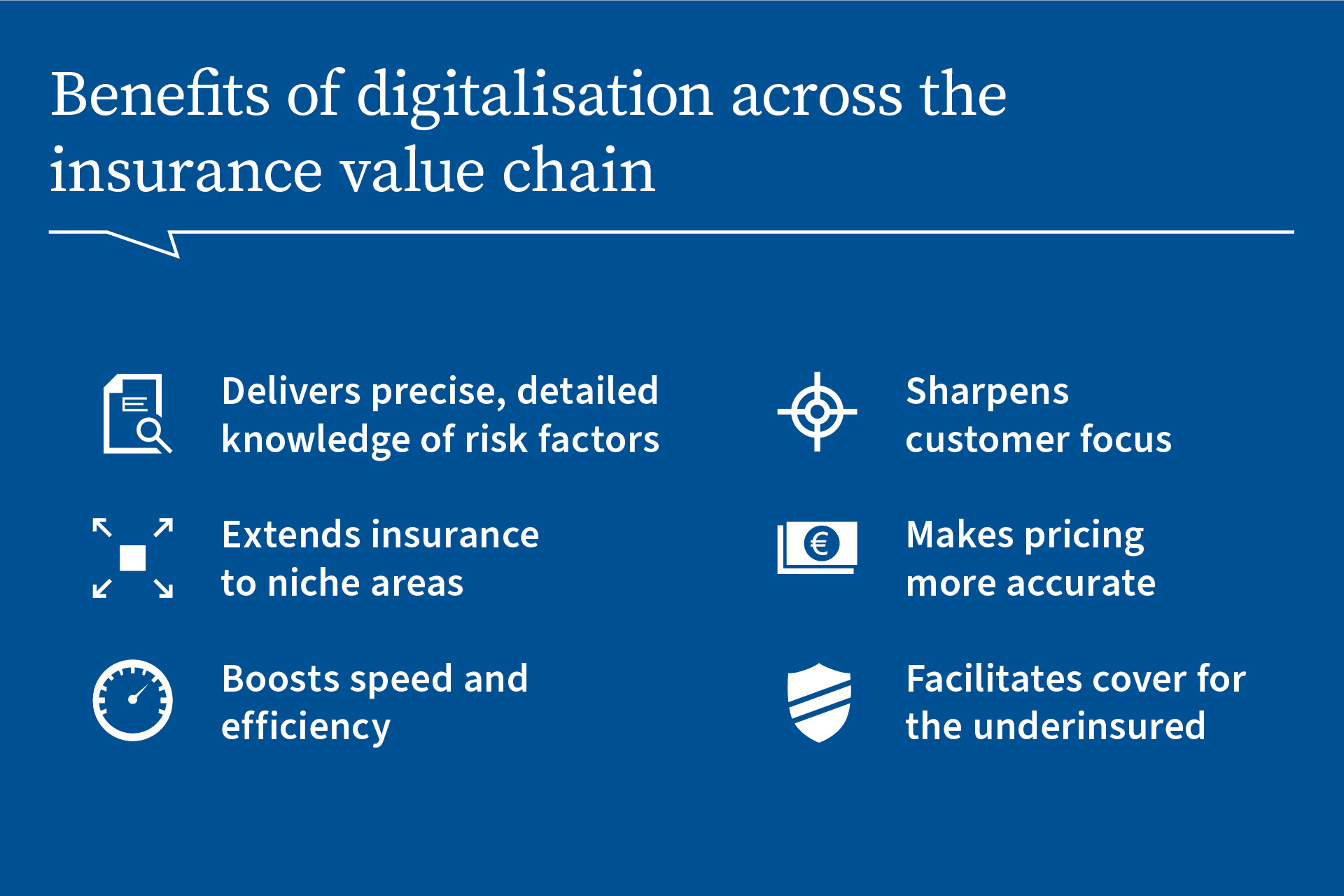

The digital age is changing the way we live, and it's quickly transforming the insurance industry. As digital technologies become more widespread, insurance companies are able to save money on a number of fronts. For example, through automated underwriting and policy issuance, they're able to cut down on paperwork and processing time. This frees up employees to focus on more important tasks, like helping customers with their claims or providing customer service in an enhanced way.

Another big benefit of digital adoption is improved customer service. Insurance companies now have access to chatbots and AI, which can help them provide world-class services that are faster and easier to use than ever before. In addition, insurance companies can now reach new markets and customers through digital advertising campaigns that are customized specifically for them.

Last but not least, adopting digital technologies has helped insurance companies streamline their business processes by automating many of the processes that used to require human input. This has saved insurers time and money while enhancing customer engagement in a very personal way. Customers feel like they're getting better care because the company takes an interest in them as individuals rather than just numbers on a spreadsheet or computer screen.

In a rapidly changing world where technology is constantly evolving, it's crucial for insurance companies to stay ahead of the curve by embracing digital technologies wholeheartedly!

Changing Risk Tolerance And Regulations

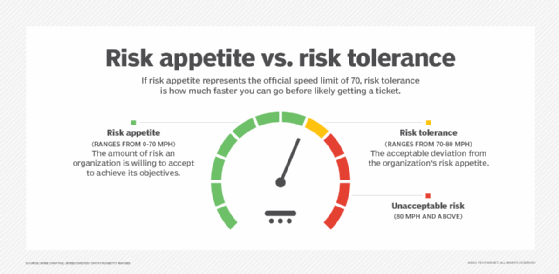

As the world becomes increasingly complex and risks are changing at an ever-quickening pace, insurance companies are facing increased challenges. Specifically, risk tolerance is changing, and new regulations are set to take effect in the near future.

One example of this is the move away from traditional underwriting methods in favor of artificial intelligence (AI). AI can be used to quickly and easily assess a policyholder's risk profile, eliminating some of the more time-consuming tasks that underwriters must complete. In addition, machine learning is being used more frequently to identify patterns in data that can help policyholders better understand their risk. This information can then be used to make informed decisions about coverage and pricing.

Data has also become a more important part of insurance decisions as insurers seek to uncover new business opportunities. By understanding customer behavior and trends over time, insurers are able to develop smarter policies that meet customer needs in a more efficient way. Additionally, big data is being used to create interactive maps that show how events like weather or earthquakes could affect specific regions. This information can help insurers make better decisions about coverage and pricing for their customers.

Cybersecurity risks are also growing at an alarming rate, which means insurers must take action sooner rather than later if they want to remain competitive. By using cyber security best practices such as layered security models and threat assessment software, insurers can protect themselves from both internal and external threats. In addition, greater awareness of climate change is creating new challenges for insurers who must consider both environmental factors (like flooding) as well as economic factors (like crop yields). As digital transformation helps carriers become more agile and adaptive they're better positioned to address these changes head on!

Exploring How Insurers Adjust With Changing Times

The insurance industry is constantly changing as new technologies emerge and reshape the way that insurance works. With data and analytics at their fingertips, insurers are able to reduce claims costs and better serve their customers. Digital transformation is helping to change customer engagement and create a more personalized experience for policyholders.

Insurers are also using artificial intelligence (AI) and machine learning to better understand customer behavior. This technology can help identify patterns in past claims data that can be used to predict future incidents. By understanding the hazards of risk, insurers can provide a more comprehensive coverage for their customers.

However, despite these positive developments, the insurance sector is faced with several challenges due to changing economic conditions and evolving customer expectations. For example, many insurers are struggling to keep up with the increasing demand for new products and services from customers who are increasingly seeking convenience and speed of service. And as the use of connected devices increases, insurers must contend with new risks such as cybercrime or data breaches. Despite these challenges, there is no doubt that digital transformation is having a huge impact on the insurance industry – both in terms of reducing claims costs and improving customer engagement.

Personalization And Customer Service Trends

As the world becomes more and more technology-driven, it's no wonder that customer service is becoming increasingly important. In fact, according to a report by Gartner, Customer Centricity: The New Normal, customer service will account for nearly two-thirds (64 percent) of all business strategy spending by next year. This is due in part to the increasing emphasis on customer service and real time engagement through digital channels.

One way that businesses are trying to meet this demand is by using automation and machine learning to increase efficiency and save costs. For example, one company can use machine learning algorithms to detect patterns in customer complaints in order to identify potential solutions before any customers have had a chance to reach out and complain. This type of personalized service can be incredibly satisfying for customers, who feel like their concerns are being taken seriously.

Another trend in customer service is the use of third party platforms in the insurance industry. By partnering with an insurance provider that uses these types of platforms, businesses can quickly access a wide range of features that were previously unavailable or too expensive. These platforms allow companies to customize their policies based on specific customer needs (e.g., weatherproofing for properties located near water), as well as track claims data and automate underwriting processes using AI algorithms. This leads to increased efficiency and cost savings for both insurers and customers alike.

As regulations governing data privacy continue to grow (e.g., GDPR), it's important for businesses to have cyber security platforms in place that protect their data from unauthorized access or theft. Chatbots – which are essentially computer programs that can mimic human conversation – are playing an increasingly important role in delivering seamless customer experiences across all channels (email, phone, chat). By incorporating chatbots into your operations, you can better understand what your customers want and need before they even have a chance to say anything! In addition, you can use feedback loops built into your platform so you know exactly how well your services are performing – great news if you're looking for ways to improve!

Comments

Post a Comment